My Role

Lead UX Researcher

( Team of 4)

Tools

Figma, Canva, Photoshop, Google Sheets, Notion

Timeline

Three Week Sprint

Project Overview:

Truist Financial

Trust is a propose-driven financial services company formed by the historic merger of equals of BB&T and SunTrust. Truist serves clients in several high-growth markets in the country, offering a wide range of financial services. Truist Bank aims to assist customers through Household accounts, providing a convenient platform for managing finances and promoting financial education among youth.

Problem

Equipping children with the essential tools and knowledge to make wise financial choices and cultivate healthy financial habits can pose a significant challenge for numerous parents. Nevertheless, it is imperative to guarantee their ability to handle household expenses seamlessly as they embark on their financial journeys.

Process

Discovery

Analysis

Ideation

Design

Reflection

Solution

Recognizing a market gap, we introduced the household concept in Truist. Banks are increasingly offering parental control debit cards for financial education. Digital banking boosts customer retention, fostering long-term satisfaction. Synced with parents and family, the household account enables real-time money movement and expense tracking. As children transition to adulthood, the account seamlessly becomes theirs, promoting customer retention and brand loyalty for generations.

Discovery & Analysis

To gain insight, we began by interviewing current Truist Users and parents with young teens struggling to find a financial medium.

“It would be nice if they offered some budgeting tips”

-

What bank are you currently with and why?

What motivated you to start using a banking app to monitor your child's spending habits and manage their allowance?

How has the banking app improved your ability to track and understand your child’s spending patterns?”

What features of the banking app do you find, or could find most useful for managing your child’s spending habits and allowance?

What were your spending habits when you were younger?

“I’d like to have a forecast view of my monthly spending”

“I want to be able to input schedule payments”

WHICH GAVE US A DEFINED UNDERSTANDING OF OUR USER

Meet Mike the Tech Savvy Dad

Mike needs a way to teach his kids and himself smart financial decisions to achieve good financial habits for when his kids start earning their first paycheck this summer and so he can manage the household bills seamlessly.

-

Mike needs an app in which he can help educate Eli’s finances and support Eli’s spending habits.

Mike needs an app in which he can oversee all his bills that way he can budget correctly.

Mikes goal is to make Eli comfortable with finances.

Mikes goal is to feel relief in knowing all his bill dates and knowing he has set all to be paid.

-

Mike is a very tech savvy parent, he has gone completely paperless and pays all his bills on his phone, he lives for a convenient banking mobile experience. He even turns the lights on and off with his phone! Mike encourages his son Eli to play educational games on his phone so that way he is having fun but learning something.

-

Mike gets frustrated that he has to manage his bills in different apps.

Mike gets frustrated when he does not have a way to help his kid understand smart finance habits

Mike gets frustrated with his limited financial literacy.

Competitive & Comparative Analysis

After analyzing our data and redefining our problem, we conducted a competitive & comparative analysis to find the gap in the mobile banking market.

Truist: Offers "Truist Momentum," promoting financial literacy and prudent spending habits.

Capital One: Provides fee waivers for customers under 18 and the option to explore investments in savings accounts.

Chase: Stands out with robust parental controls, no overdraft fees, widespread ATM access, and task/allowance assignment.

Greenlight: Offers features like expenditure controls, financial education resources, instant fund transfers, and advanced parental controls.

Design Insights

Support: In our commitment to better understand and support our users, we conducted comprehensive interviews with Jamie, focusing on those using electronic and mobile banking services. Through these efforts with seven representative users, we identified challenges such as dissatisfaction with call wait times, restricted chatbot access, and concerns about inconsistent application design elements.

Design: Users strongly preferred banking apps that allow task execution without physical visits to a branch, a sentiment echoed in user reviews on the Apple App Store for banking applications.

Functionality: We discovered limitations and functionality issues with pivotal features like Face ID and Mobile Check Deposit in SunTrust and BBT mobile apps based on user feedback in app store reviews.

Prototype

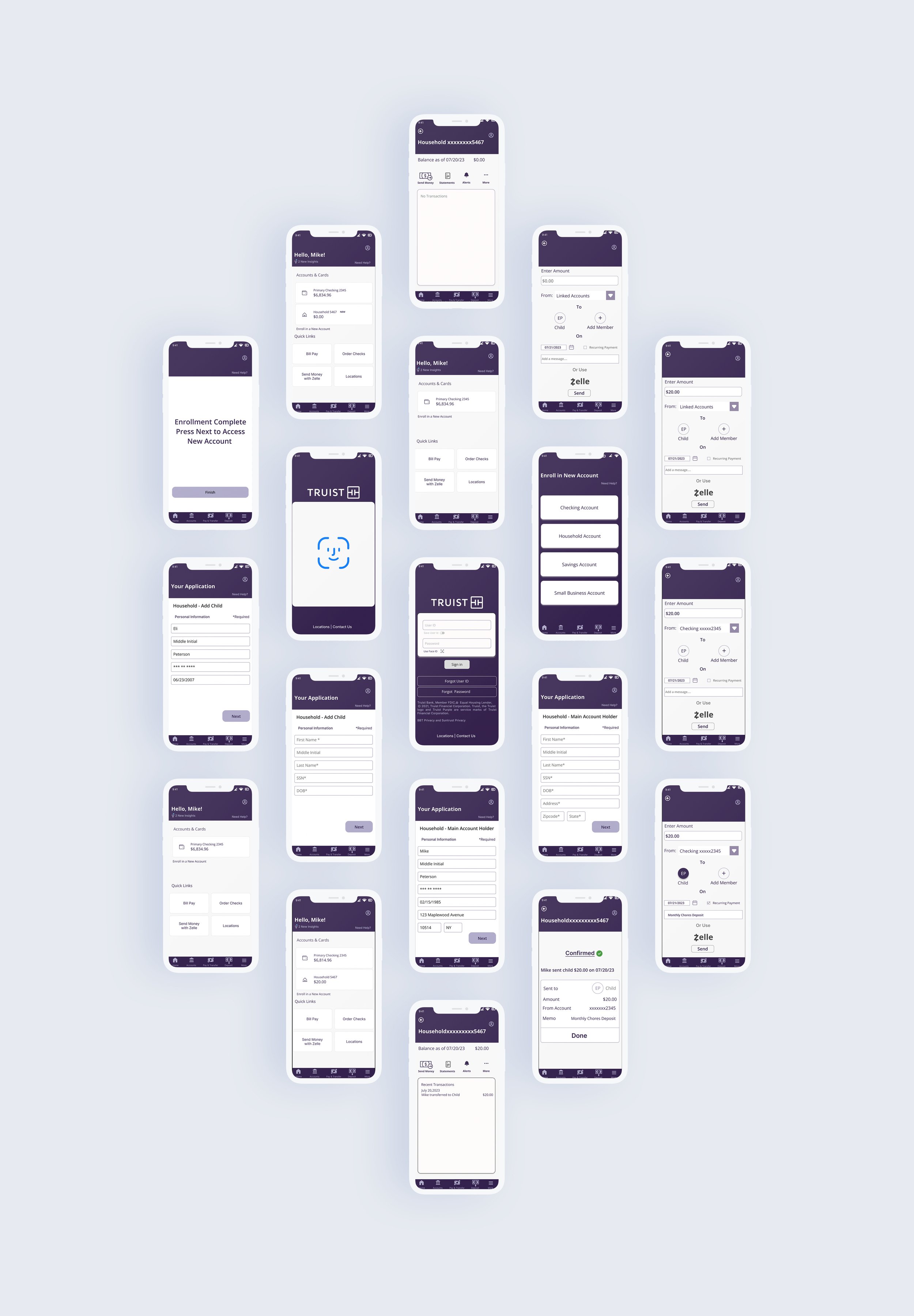

And finally… our final prototype! Our prototype depicts our user Mike logging onto his Truist mobile banking account, setting up a household account, and then sending a recurring payment to his son Eli.

User flow

We have discerned two user flows that warrant prioritization following comprehensive research and task analysis. The initial flow is oriented towards mobile functionality and revolves around creating a Household Account. This account is a collaborative platform for Mike and his son, facilitating shared learning experiences.

Usability Testing

After low-fidelity usability tests, we observed users preferring Zelle over the Household Account for transferring funds from a shared account. To address this, we introduced an enrollment link in mid-fidelity testing, resulting in a streamlined and error-reduced task completion process. In high-fidelity testing, we refined the enrollment process to align seamlessly with Truist's procedures.

Design Iterations

Users demonstrated high proficiency and positive sentiments about the mobile interface. Based on feedback, we incorporated enhancements like enrollment confirmation and payment verification in this testing iteration.

After understanding our users and redefining our problem and solution, we were able to begin developing our wireframes.

Wireframing leads us to the next step…. prototyping!

Design

Typography & Colors

Truist collaborated with human behavior experts and design agency Interbrand to create a distinctive color palette, merging BB&T burgundy and SunTrust blue for a confident and approachable brand identity. While Interbrand shaped the overall brand, our team focused on enhancing the user experience for tech-savvy parents. We aimed to harmonize typography in the website redesign with the Truist theme, choosing the adaptable Open Sans font. We ensured distinctiveness between headlines and body text through careful styling adjustments, showcasing Open Sans's unique characteristics.

Accessibility

Diversity holds significant importance to us, and we acknowledge the potential hurdles encountered by users with disabilities while engaging with technology. In our commitment to fostering accessibility, we introduced a Face ID authentication feature for streamlined login procedures. Furthermore, we have meticulously selected visually legible color palettes and fonts, ensuring consistent application throughout our interface.

Reflection

Results and Impact

Following our comprehensive usability testing, we observed a noteworthy increase in success rates, particularly within the medium to high-fidelity testing phase. The direct success outcome for users reached an impressive 75%. This notable improvement can be attributed to the incorporation of a prominent enrollment link for household accounts. This strategic addition provided users with enhanced guidance and clarity as they navigated through the application, contributing significantly to the overall success of the user experience.

Main Challenge and Leason Learnt

The principal challenge that presented itself pertained to my initiation into group UX projects. Despite my initial apprehension, I quickly adapted to the collaborative environment. My team and I adeptly employed tools like Notion to facilitate task management and maintain a clear delineation of responsibilities. This experience underscored the paramount importance of efficient communication and the judicious allocation of time. Regular daily stand-up meetings emerged as a pivotal factor in the project's overall success.

Through this project, I gleaned the profound satisfaction derived from teamwork, collaboration, and the synergistic process of crafting design solutions in unison with others.